Yearly depreciation formula

The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. Under the SYD method the depreciation rate percentage for each year is calculated as the number of years in remaining asset life for the.

Depreciation Calculation

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year.

. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase. 80000 5 years 16000 annual depreciation amount Therefore Company A would depreciate the machine at the amount of 16000. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

If we use the Straight Line method this results in 3 remaining. Divide step 2 by step 3. Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12.

Note that this figure is essentially equivalent to. For example 25000 x 25 6250 depreciation expense. In period 8 Depreciation Value DDB 41943.

If you use this method you must enter a fixed. In April Frank bought a patent for 5100 that is not a section 197 intangible. Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. What is Sum of Years Depreciation SYD. Total Depreciation - The total amount of depreciation based upon the difference.

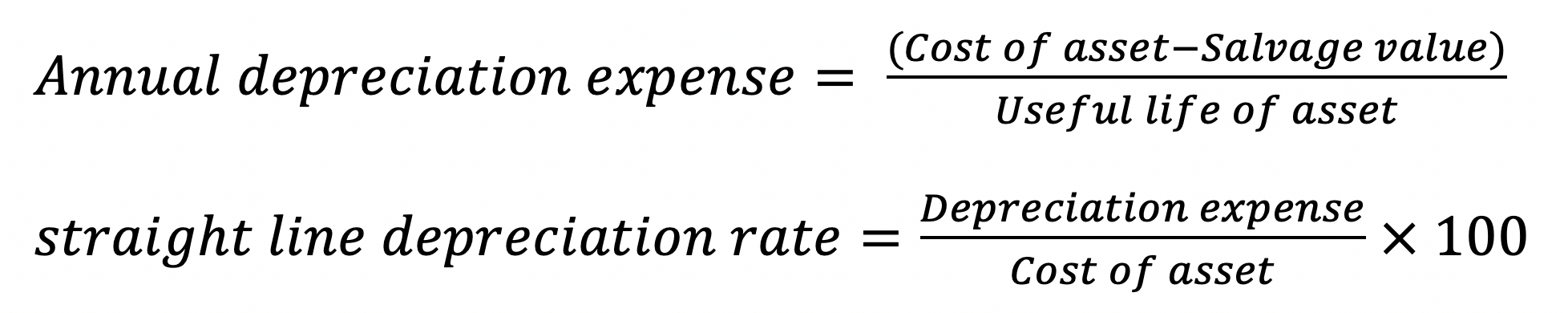

The depreciation rate 15 02 20. He depreciates the patent under the straight line method using a 17-year useful life and no salvage value. The amount of annual depreciation.

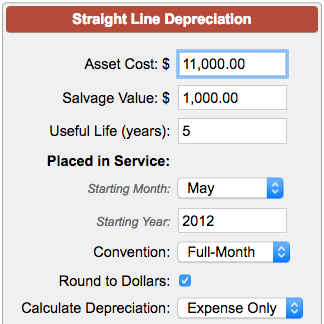

Straight Line Method SLM Under the depreciation Straight Line Method a fixed depreciation amount is charged annually during the lifetime of an asset. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. The syntax is SYD cost salvage life per with per defined as.

We still have 209715 - 1000 see first picture bottom half to depreciate. Multiply the rate of depreciation by the beginning book value to determine the expense for that year. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method.

Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value To calculate this value on a monthly basis divide the result by 12. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate Annual. For example the first-year.

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Calculator Sale Online 57 Off Www Ingeniovirtual Com

Depreciation Rate Calculator Flash Sales 56 Off Www Ingeniovirtual Com

Straight Line Depreciation Formula And Calculation Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Aasaan Io Blog

Depreciation Formula Examples With Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Expense Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Annual Depreciation Of A New Car Find The Future Value Youtube